The euro zone country narrowly avoided an international bailout in 2013, when the government poured more than 3 billion euros ($3.4 billion) into local banks to prevent them from collapsing under a large amount of bad loans.

"Apart from SID Banka, which has a special role, the banks will be privatised in whole, while there is a chance that the government remains minority shareholder in NLB (Nova Ljubljanska Banka)," said Metod Dragonja, state secretary at the ministry.

SID Banka is a state-owned export and development bank tasked with financing exporters and small and medium sized businesses, while NLB is Slovenia's largest bank and is also fully state-owned.

Since becoming independent in 1991, Slovenia has been reluctant to sell its major banks so the government controls more than half of the country's banking sector.

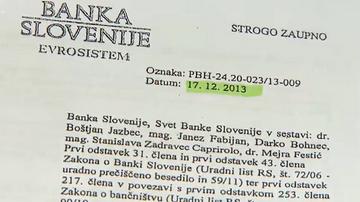

The government hopes to sell number two bank, Nova KBM (NKBM), in the coming weeks. The process has been delayed by complaints from small shareholders and subordinated bond holders who say the bank should not have erased the shareholders' capital and subordinated bonds when it was rescued by the state in December 2013.

The International Monetary Fund urged Slovenia last December to sell all state banks, while the European Commission has also advised to privatise its lenders.

Oglas